- Start date

- Duration

- Format

- Language

- 11 Sept 2024

- 6 days

- Class

- English

Identifying growth opportunities and drive innovation with a strategic agenda, understanding key external trends and effectively merging financial and market perspectives.

Reliance does it again. We woke up yesterday with news that Reliance and Disney are finalizing a merger deal term sheet that would have Disney operations in India (under the Disney Star banner) to be absorbed by Viacom18, the media arm of Reliance. The term sheet still has to receive approval from both sides before the official announcement, which might take another month. You can call it a merger but with 51% of Star India shares going to Reliance, it is clear who ultimately controls the new company. Is this another success of the recurring Reliance strategy of throwing money at a business until the competitors give up?

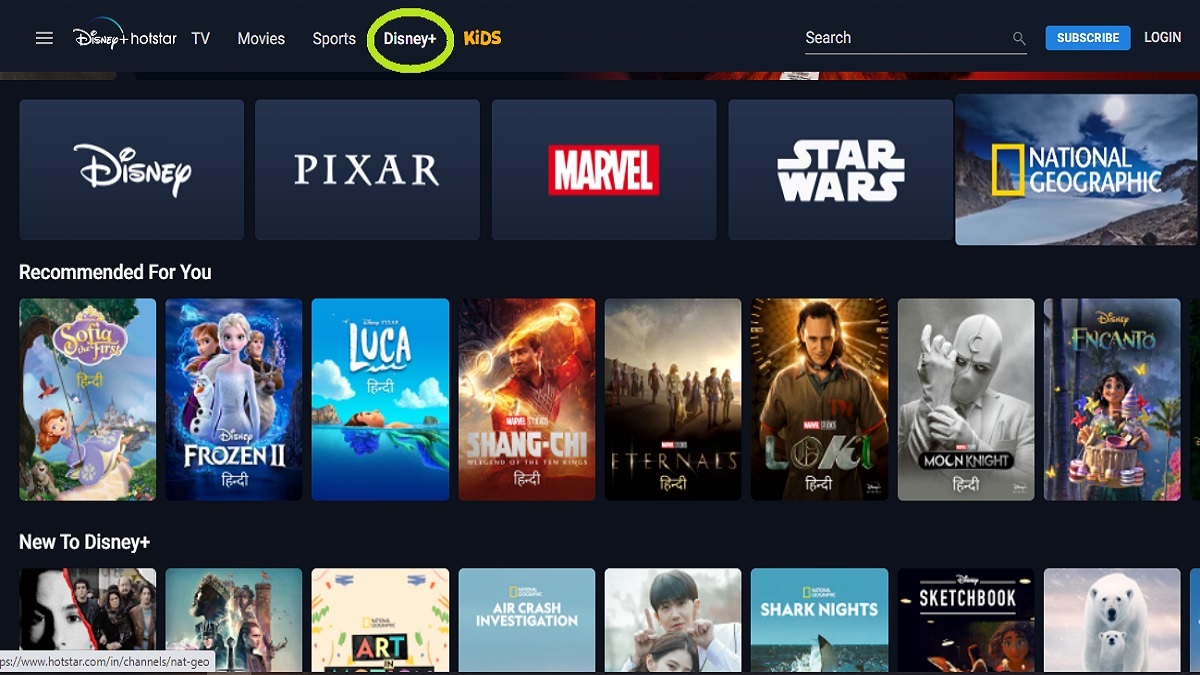

Life seemed wonderful for Disney Star in 2019. Disney had just completed the acquisition of Star India, the largest media company in India at the moment, bringing together Disney’s global content and Hotstar’s local assets. Next to Netflix and its struggles in India, or the undersized Zee5 and Sony, and with a very profitable linear TV business with more than 70 channels and an OTT platform (called Disney+ Hotstar) boosted by Disney content, it seemed an unbeatable combination.

Enter Jio and its plans for dominating all the strategic sectors. Jio came into media distribution as it has come into many other industries, that is, by leveraging its deep pockets and its customer acquisition might (for starters, Jio has 445 million mobile subscribers!). One of the very first moves was to acquire the IPL streaming rights at a $5 billion cost and offer the entire tournament as a free subscription to its OTT new platform JioCinema. Considering that IPL attracts an audience of about 500 million, it is not surprising that offering it for free netted JioCinema most of its current user base of around 250 million users. Since Disney+ Hotstar leading position owed just as much to cricket and premium content, a full zero-sum game started between the two platforms. Jio’s gain was Hotstar’s loss, measured at more than 23 million subscribers lost in a year (!).

In addition to Jio’s grand entrance, Disney Hotstar had to contend with a very typical weakness of foreign companies in India, which is their unwillingness to engage in protracted low-profitability mud fights. It is not a secret that with the return of Bob Iger, The Walt Disney Co. entered a period of streamlining and cost rationalization, which generally means a switch of focus from growth to profit margin. Nothing wrong with that in general but highly challenging when the margin priority is applied to the Indian market, especially in mass-market businesses. For instance, in the Indian OTT segment and unless you are Netflix, you are playing with a yearly revenue of around 1,500 rupees (about 17 euro) per subscriber, which also drops significantly if you are running a freemium model with most of the user base not paying anything. If you are looking for an attractive ARPU, this is not the place. Per The Economic Times, Bob Iger is reported saying that “we’d like to stay in India. It is now the most populous country in the world, and we’d like to stay in that market. But we’re also looking to see whether we can strengthen our hand obviously, improve the bottom line”.

For Disney+ Hotstar, improving the bottom line in a market where Jio is in the initial years of its trademark “boa constrictor” strategy (give lots of value for a very low price and see how long the competitors can survive), where two able competitors like Sony and Zee5 just merged to gain size and muscle and where Netflix might corner the richer segments, is a very very complicated proposition.

So it is not surprising that Disney might be thinking consolidation, as that is a standard strategic response in a market where size is not so much an advantage but a survival necessity. And so the rumors about a possible merger with Jio that had been filling pages in the media recently seem to have become a reality. If you cannot fight them, join them, as the saying goes.

A merger between Jio and Disney+ Hotstar will create a company with more than 100 linear TV channels and 2 streaming platforms (thus offering enormous cost optimization opportunities), with exclusive premium content from Disney and HBO (the latter from a separate deal) and with the production power of Reliance Studios and The Disney Co. on the content creation side. Most importantly, it will create a company with a combined user base likely to reach 500 million soon (for comparison, YouTube has 462 million active users in India) and a paid subscriber base that will put the resulting OTT business leagues ahead of the rest of the field. And with one of the companies in this deal, Reliance, controlling a big chunk of the entire value chain (the mobile data plan, the home internet, the 5G network, etc.) Game over?

And what does this story say about the chances of large global companies in India? As much as CEOs like Iger might like the growth, they also must be willing to challenge strong local competitors who know how to fight with thin margins and patience. I sense a certain “we want to have it both ways” mindset in those foreign companies, as if the red carpet will be laid out for them by virtue of their global brand. Let the carcass of Disney (because in the end, this is a capitulation) show them that growth and market share in India have to be earned with a good amount of pain.