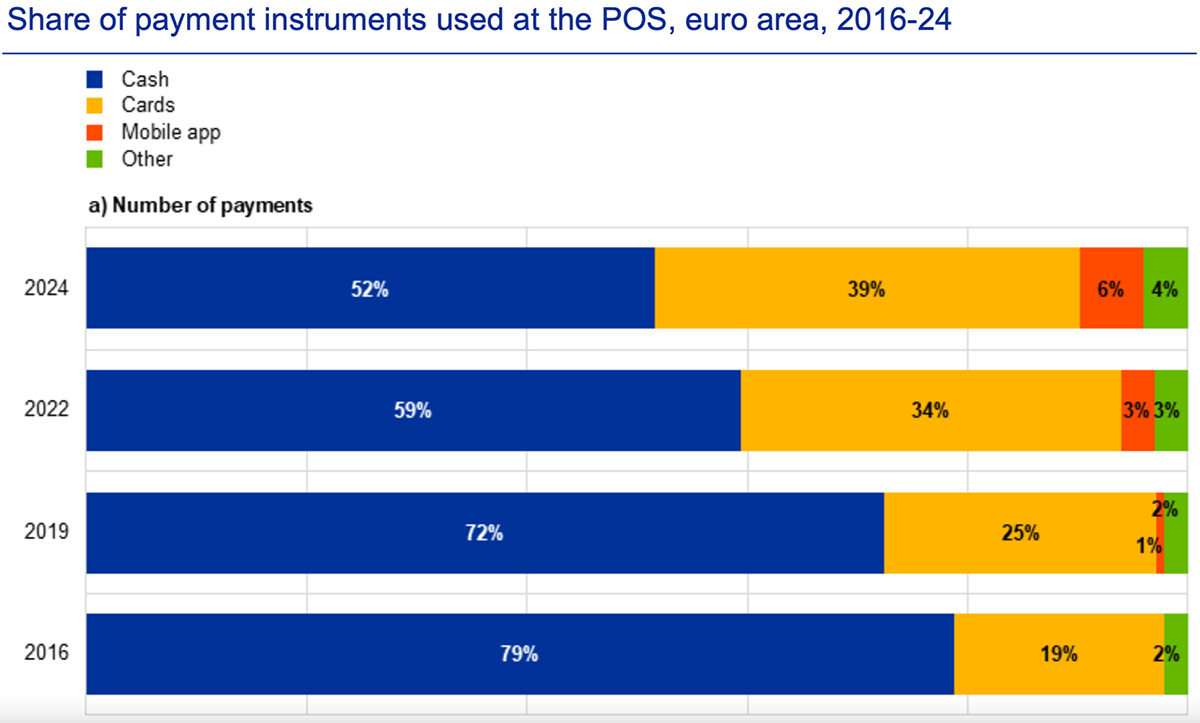

Today, every time a European citizen uses a digital payment method, they are (often unknowingly) taking two important steps:

- First, they’re using private money, i.e., money not issued directly by the ECB. When paying with a credit card or a digital app, the transaction is recorded in the books of a private financial institution, such as a commercial bank.

- Second, if the payment is made via credit card (whether a physical card or through Apple Pay, Google Pay, etc.) the infrastructure that’s used belongs to private, non-European providers like Visa and Mastercard.

In this often-overlooked context, cash remains the only form of public money that’s still available to European citizens. It’s a direct liability of the ECB, not of commercial banks. Despite often being stigmatized as a tool for the shadow economy, cash remains the only payment method fully guaranteed by the ECB.

So, what’s the risk for Europe?

Piero Cipollone, ECB Executive Board Member, made it clear during a hearing before the European Parliament’s Committee on Economic and Monetary Affairs on April 8, 2025. In his words:

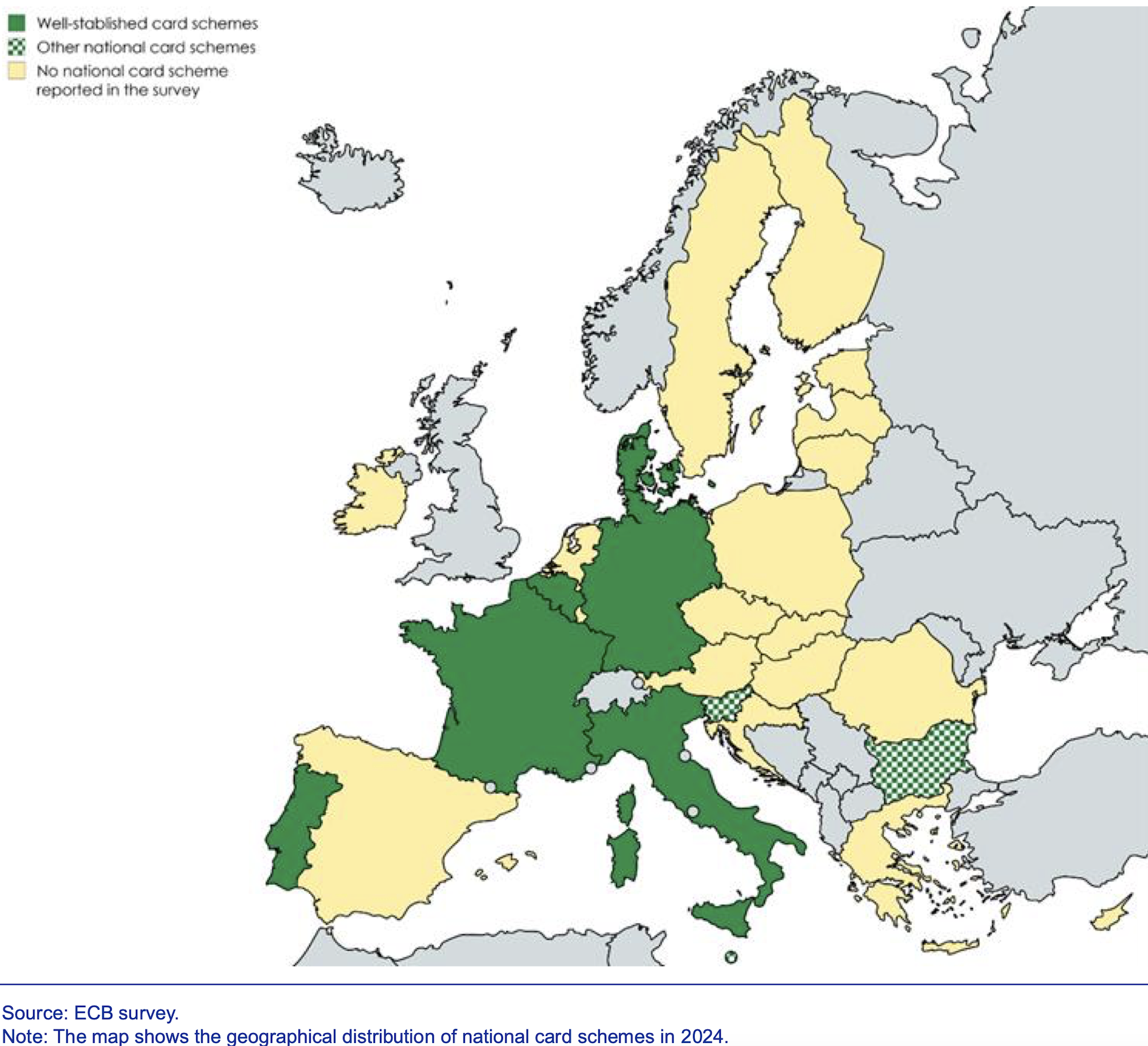

“Consumers are increasingly choosing to use digital payment methods in stores and for online purchases. But for many of these transactions, we rely on non-European providers. Today, citizens in 13 Euro-area countries depend solely on international card schemes or electronic payment solutions for retail purchases. Any existing national card scheme also relies on co-branding with international networks to enable cross-border transactions within the Eurozone. Soon, this situation could lead to dependency on foreign private payment systems.””

In short, Europe risks losing direct control over its own currency if citizens continue to rely solely on non-European digital tools. This would mean both technological and financial dependence, with far-reaching implications for the Union’s monetary sovereignty.

.jpg)